I am an insurance advisor in a small town agency in Ohio with five office locations, all located in rural areas. We’ve been around since 1920, so every stereotype of legacy systems, mentality and “the old way of doing things” have certainly been thrown at us over the years. However, throughout our history, we’ve never lost sight of our “why”. We exist today because we take care of people: our clients, our associates, and our partner insurance companies.

But don’t interpret that as complacency. Or an old-school agency stuck in its ways.

The fact is, we’re making major investments in technology, but not because we believe technology will replace the relationships we’ve spent nearly 100 years cultivating.

Quite the contrary.

We believe that to truly fulfill our purpose of taking care of people, technology must integrate into our culture to enhance the relationship we have with our clients. And every technology we implement must free up our associates’ time to do what they do best – what no technology will ever do – helping people protect what matters most in life.

It was this aha! moment when we realized that embarking on a path to becoming a digital agency was not only necessary, but in complete alignment with our cause.

So here’s what we’ve done.

We identified three purposes for technology within our organization:

- Empower our associates – This is our internal technology strategy

- Better manage relationships with our existing clients to improve retention – This is our external technology strategy

- Develop new opportunities by finding clients aligned with our values not yet on our radar – This is our inbound technology strategy

Internal Technology

We needed a solution that not only helped our associates take better care of our clients, but was easy and efficient to use, so that they’re spending less time on data entry and more time on communication.

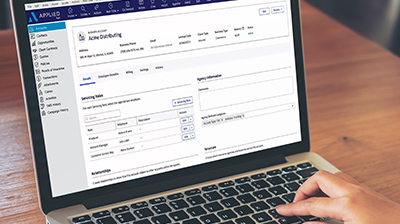

For us, that solution is Applied Epic. We can leverage technologies directly in our agency management system – download, workflows, reporting, CRM, anytime/anywhere access – to free up more time for our advisors to actually advise our clients.

Applied Epic provides us with a holistic view of our five agencies, allows us to manage the sales cycle for our producers, and when this cloud solution is combined with the power of Applied Mobile, it positions us as an organization desirable to potential associates, especially millennials, that want the same tech integration in their professional life as what they depend on in their personal life.

External Strategy

While we firmly believe no technology will ever replace the relationship agents have with their clients, we stand firm behind the belief that it’s absolutely critical for us to implement technology solutions that make our clients’ lives easier.

A good example: We’re using Applied CSR24 so that clients have anytime access to their policy information, and can utilize this solution for the more transactional workflows where they’d prefer to deal with a technology solution versus a human.

The client wins because they utilize a technology they’re not only comfortable with, but actually favor instead of picking up the phone to call us.

Our advisors win because it’s one less data entry task that needs to be completed, and now they have more time to spend on the challenges that require brain power instead of computing power.

Inbound Marketing

We’ve deployed a dual approach to our inbound strategy:

- Content Marketing – we’re constantly developing content that speaks directly to the types of clients we’re trying to attract, measuring and analyzing the results with tools accessed via HubSpot, and adjusting as necessary. And it’s working. In 2016 alone, $43,277 in revenue was directly attributable to our digital presence.

- Partnering with organizations that share our vision of technology enhancing the value of an independent agent. For example, we partner with TrustedChoice and Agency Nation to harness the power of connecting the right insurance buyer with the right agent.

Conclusion

This is by no means a complete list of everything we’re doing, or each technology we’re using. But it certainly touches on those making the most significant impact to our business today, and perhaps more importantly, what we see as critical to our future.

Two takeaways I’d love for you to get from this article:

- We didn’t make all these investments overnight. This digital path is one we’ve been on for the better part of seven years now. And we’re definitely not perfect. I’ve made more than my fair share of mistakes over the years. But we test, implement, learn and revise as necessary. And if we, an agency that’s been around since 1920, can do it, so can you.

- You don’t have to go it alone. Once we identified where we wanted to go from a digital perspective, I’ve been amazed at the number of strategic partners that have aligned so well with our purpose.

Let’s stop viewing technology as the major disruptor to our industry, and start leveraging its power to do what we’ve done so well for hundreds of years – advising our clients. After all, I’d love to have a business that my son can not only perpetuate one day (he’s only 3 ½ years old so I have some time), but one that he’s passionate about in an industry that’s thriving.

Who’s with me?

By:

By: