Technology is now essential to how insurance agents and brokers run their businesses, including how they serve existing clients and attract new ones. To fully realize the benefits of being digital, forward thinking agents and brokers are embracing technology to fully automate all aspects of their operations and customer service.

Beyond the four walls of the business, independent agents and brokers are pursuing technology solutions that help them connect with all stakeholders in the insurance industry, including capabilities that provide for the seamless exchange of information back and forth with their insurer partners. Perhaps most importantly, the expectations and preferences of the end customer, the insured, are evolving rapidly so leading agencies and brokerages are increasingly adopting solutions that help them connect with customers and prospects, when and how they want, via online and mobile. The core competency of any strong agency or broker, providing trusted advice to the insured, remains paramount, but the promise of digital presents exciting new possibilities to better serve customers and emerge as a stronger competitor in the years ahead.

5 Core Capabilities That Define a Digital Agency or Brokerage

So, what exactly does it mean to be “digital” and how should an agency or brokerage approach this opportunity? There are five pillars that work together cohesively to support a business’ digital growth strategy, each providing the core capabilities needed to operate more efficiently, make more informed business decisions, build better insurer relationships, improve customer service, and accelerate growth and profitability across all lines of business.

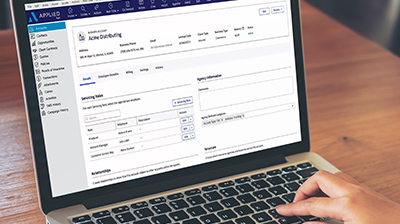

- Foundational Management System – First and foremost, focus on building a strong internal foundation based on information and visibility. A world-class management system drives the day-to-day operations at an agency or brokerage, enabling the business and all employees to be as efficient and effective as possible. With a single management system, agents and brokers efficiently manage customer relationships, policy and benefits administration, sales automation, financial accounting processes and document management across the entire business in one application.

- Data Analytics – As they head down the “digital” path, agents and brokers will find that they generate and have access to more and more data, which raises the challenge of how best to make sense of it. Historically, agents and brokers sat on mostly transaction level detail in various systems without ever realizing the potential of that information. Business intelligence and analytics solutions allow agents and brokers to transform the vast amounts of data within the management system into simple, visual insights for data-driven analysis of business performance. A digital business leverages technology to make their data more consumable, which leads to better insights about the business and, therefore, more informed decision-making by agency and brokerage leaders.

- Insurer Connectivity – “Digital” also applies to how agents and brokers can work more effectively and efficiently with insurer partners. In simplest of terms, insurers, agents and brokers have an interest in efficient and secure exchange of information, directly from insurer systems to management systems and back. Digital businesses that capitalize on this seamless interaction provide faster and more accurate quotes and information to their clients. They do less manual data entry and they make fewer mistakes. Additionally, digital businesses use rating technology to obtain timely and accurate rates, a crucial step in the selling process that demands quick and accurate information exchange. Lastly, innovative market search tools help digital agents and brokers expand in to new areas of commercial lines business, serving up insurers that write specific policies. All of these technologies contribute to a more seamless, connected ecosystem of data exchange.

- Mobile – Mobility and mobile apps are now ubiquitous. Mobile solutions can enable staff to be more productive and better connect with insureds. Agents and brokers are embracing mobile technology to meet the needs of all employees and, further, to respond to the increasingly common expectation by insureds to interact via mobile. Mobile extends the agent’s and broker’s role as a trusted advisor by providing an additional servicing channel, which allows insureds to interact how and when they prefer.

- The Cloud – We have seen tremendous cloud adoption in our industry. Digital businesses are trusting the cloud to run their critical applications and manage their data. The cloud allows agents and brokers to safeguard data and provide better customer service from anywhere.

With all the technology options available today, the sky is the limit for independent insurance agents and brokers. We are in the early stages of a multi-year transformation, and the pace of adoption is steadily accelerating. I believe our industry stands to change quite dramatically in the years to come, and it’s for the better! At its core, a “digital” transformation is about realizing an opportunity to better service clients and create an enduring and more profitable business. The digital transformation is for the good of the insurance industry and it presents an unprecedented opportunity for our industry to emerge stronger than ever before.

Interested in hearing from independent agents and brokers who have made the digital transformation?

By:

By: