We're always excited to discuss artificial intelligence (AI). Can you blame us? It's fascinating to think about how it will revolutionize the insurance industry in the following year and into the future. In this very moment, AI is streamlining repetitive tasks, giving brokers more time in the day to strengthen relationships, and much more. While it's already creating meaningful change for brokerages, we understand there are still plenty of questions about this technology.

At Applied Systems, we're excited to partner with brokerages to embrace the Next Generation of Insurance and harness the power of AI to bring value to businesses. We understand the complexities, questions, and sometimes concerns about using AI in the insurance industry, so let's explore how the digital roundtrip will be AI-powered and how we’re investing in AI.

Does It Matter Which AI You Use?

It’s important to acknowledge that not all AI tools are created equal. Understanding these differences and how to best leverage AI will help businesses long into the future.

Generative AI has both Vertical and Horizontal applications. Vertical AI is industry-specific AI that tailors its abilities to meet unique needs and is created to tackle industry challenges and workflows. Horizontal AI is for more general purposes and has a wide range of abilities but lacks industry-specific functions or features. While both are useful, experts agree that Vertical AI solutions will be the most valuable.

Vertical AI solutions allow your team to benefit from AI capabilities tailored to your brokerage. We want brokerages to feel confident knowing the AI they're using has domain expertise and can integrate seamlessly into existing systems they already trust.

How Do You Turn AI Challenges in Insurance Into Opportunities?

Implementing and using AI doesn't come without challenges. While these are challenges brokerages can overcome to experience the benefits of leveraging AI, it's still important to be aware of them.

AI implementation comes with hurdles, but these challenges pave the way for transformative growth. Concerns like ROI uncertainty or balancing automation with personalized service are valid, but they’re also manageable. Success lies in leveraging AI strategically—partnering with experts ensures you maximize its impact. Remember: AI empowers your team to be more efficient and innovative; it doesn’t replace the human connection your customers value.

Additionally, safeguarding customer data is non-negotiable. Robust encryption, threat detection, and regulatory compliance are essential to maintaining trust. Integration challenges? They’re opportunities to build smarter workflows tailored to your operations, making AI a seamless part of your business ecosystem. With thoughtful planning and the right tools, AI can be a game-changing asset for your brokerage.

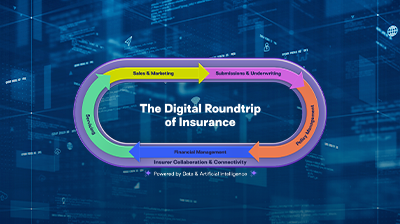

Connecting The Digital Roundtrip with AI

Why do we care so much about AI? We believe AI will have an impact on every aspect of the digital roundtrip of insurance, which will help make our services more intelligent, productive, and automated. This includes sales and marketing, submissions and underwriting, policy management, and servicing.

Our vision is to embed practical, intelligent automation throughout the entire insurance lifecycle. From start to finish, we will invest in AI that positively impacts our products, the process in which brokers work, and the brokers themselves. Leading industry analysis from Bain and McKinsey expects that AI will help brokerages bring in 30% more revenue from more effective cross-selling and increase productivity by 40-50%

Let's break down our vision and investments in AI throughout the digital roundtrip.

Sales and Marketing

Not all brokerages have dedicated marketing departments, but they all need engaging content to retain and attract customers. An integrated tool built specifically for insurance brokers to create concise and engaging content is best accessed natively within the Broker Management System (BMS). AI tech that uses Large Language Models (LLMs) will learn how to create emails and social media posts that best fit your business. It gives brokerages a starting point to personalize content so that it matches your voice and content goals, while saving the time you'd spend if you started from scratch.

Submissions and Underwriting

Leveraging the connectivity between Applied Systems and the insurers will create the opportunity for efficient collaboration between the underwriter and broker, all within a single system. AI-augmented submissions will then be routed seamlessly to underwriters for a more consolidated review and even faster processing. We understand that communication is everything and being more aware and knowledgeable makes brokerages more successful and efficient. Questions on missing information or submission status will be resolved smoothly. Time is one of the most important resources, and AI-powered tech enables brokers to make decisions faster. What could you accomplish if you didn't have to spend hours searching through emails for information?

Policy Management

Identifying the right markets and coverage is time-consuming and can result in missed opportunities. With an AI-powered growth engine integrated natively in the BMS, brokers can identify high-probability cross-sell and upsell opportunities more easily. Renewals are key to growth but managing them can often feel inefficient. It’s time to make that process productive, efficient, and a driver of success. AI tools will help brokers access information to see where coverage gaps are and deliver insights to best fit the customer's needs. This takes a once-time-consuming task and turns it into a more streamlined and profitable process.

Servicing

Rambling, long-paragraph styled emails make for longer reading and processing time. Brokers then must spend longer to identify takeaways and actionable items. Leveraging AI to help make activities, summarize key points, and find information you need faster will only make your workday more efficient. AI-amplified servicing tools will enable brokerage team members to access and execute tasks like identifying accounts, enhancing customer communication, and adding activities in less time. Taking care of tasks like these will make room for working on bigger picture goals.

The Partnership Between Humans and Artificial Intelligence

AI in insurance is making incredible advancements, and we can't deny that it's transforming the industry in powerful ways. Despite these advancements, AI isn't replacing insurance professionals; it's empowering them. It's creating a partnership that allows technology to optimize and take care of repetitive tasks, while the people focus on building better relationships and making more complex decisions. Marketing campaigns will become more targeted and personalized, and producers will engage with prospects right in front of them instead of staying behind their screens.

AI is transforming how people work and the skills they bring to the insurance sector. It's becoming a key element in hiring decisions and staff training. The Microsoft 2024 Work Trend Index Annual Report found that 77% of leaders say that early-in-career talent will get greater responsibilities due to AI, and 66% said they wouldn't hire someone without any AI skills. Please make this sentence a different colour to make it pop

AI won't replace the hard-working, passionate people in the insurance industry. People have always been at the heart of this industry, and that's not going to change.

Harnessing the Opportunity of AI

AI is changing how brokerages operate and the insurance industry itself in ways we couldn't have imagined several years ago. How we invest in artificial intelligence now is crucial for how we use it in the future, and how the customer experience benefits from it. We're focusing on how we can invest in AI to create solutions that help brokers achieve their bigger picture goals and transform the processes they use to do business. We're excited to solve some of the industry's most pressing challenges with an AI-amplified digital roundtrip of insurance. Check out our resources to learn more about our vision and strategy.

-

Anupam Gupta

Chief Product Officer, Applied Systems

Anupam Gupta, Chief Product Officer, is responsible for the company's product vision and product management teams. Formerly CPO at 4C Insights, a sophisticated Data & Analytics SaaS provider to the AdTech/MarTech industries, which was acquired by Mediaocean, the mission-critical platform for omnichannel advertising with more than $200 billion in annualized media spend managed through its software, connecting the ecosystem of agencies, brands, media, technology, and data. As CPO of the combined companies, he spearheaded their product transformation to the cloud, adding new products fueled by data and intelligence infused in the core workflow. Previously, he’s led product organizations for several tech companies, including at Vubiquity, Mixpo, and Microsoft among others.

Subscribe to the Applied Systems Blog

Fill out the form to receive the latest blog posts delivered directly to your inbox.