In today’s fast-paced insurance landscape, where complexity and competition are continually increasing, artificial intelligence (AI) stands as a pivotal force for transformation. At Applied Systems, we are confident that AI tools for insurance agents will empower insurance professionals to dramatically streamline workflows, elevate accuracy, and unlock new avenues for growth. Let’s break down how AI is a catalyst for transformation in the insurance industry and why this is true.

Intelligent Workflows that Empower Insurance Agencies and Unlock Greater Efficiency

One of the most pressing challenges that insurance agencies face is manual, fragmented workflows that drain valuable time and resources. Whether it's processing commercial lines submissions laden with email attachments or managing complex data entry in personal lines, the current state is inefficient and costly. AI changes this by integrating directly into your existing operations, not as an afterthought, but as an embedded, intelligent assistant.

We have observed how agencies can move from spending hours per risk submission to completing these tasks in mere minutes. This is no incremental improvement; it is a paradigm shift. For instance, by leveraging natural language processing and advanced document classification, the system can distinguish between loss runs, supplemental materials, and CVs within multi-attachment emails. It then digitizes, validates, and enriches this data seamlessly. The immediate benefit? Agency teams can focus on client relationships and underwriting judgment instead of data wrangling.

From Chaos to Clarity: Turning Unstructured Data into Decision-Ready Insights

The enormous volume of unstructured data – PDFs, emails, spreadsheets – has long been a roadblock to efficiency and accurate risk assessment. AI-powered platforms like ours transform this chaos into clarity. By automating the extraction of critical data points and cross-referencing them with third-party sources, we create comprehensive, clean datasets ready for evaluation.

Consider this: a business auto submission might contain over 265 data fields across multiple documents, each with potential errors or missing values. Our AI technology not only flags inconsistencies but allows users to correct and confirm details within moments. Subsequently, this data feeds into established underwriting guidelines and appetite models, providing computed fields that greatly accelerate decision-making.

Importantly, the AI capabilities are designed to integrate smoothly with your existing policy and management systems. There is no need to abandon familiar tools; we help enhance them. This means less rework, fewer errors, and faster turnaround times—cornerstones for improving both employee productivity and customer satisfaction.

Collaborative AI-Powered Tech Driving Real-World Impact for Insurance Agents

Innovation occurs fastest and has the greatest impact when developed in partnership with those who understand the business intimately – you, the insurance professionals. That’s why our approach is not merely technology-first but problem-first, inviting agencies to participate in pilots and co-creation programs.

This collaboration uncovers the nuanced pain points – from capturing plan details within summary of benefits and coverage documents that can take an agent upwards of 30 minutes each, to the overwhelming hours spent manually transcribing carrier documents. Our Voice of Market surveys underpin our strategy, consistently identifying manual data entry as a prime target for AI-driven automation.

Through these partnerships, we ensure our platform delivers measurable outcomes: reductions in processing times, increased gross written premium per employee, and a stronger position to serve clients with precision – even during peak periods or unexpected spikes in volume. This is not about replacing expertise but using AI to remove tedious and time-consuming tasks from your daily workflow.

Why Do AI-Driven Solutions Matter?

At its core, AI is a tool designed to augment human intelligence and refine workflows, not a replacement. By transforming data into decision-ready information and using intuitive search and evaluation tools, your agency can focus on high-impact activities like advisory conversations, strategic growth, and personalized customer experiences.

Real-world results reinforce this promise. Agencies using these AI platforms report noticeable improvements in speed and accuracy, translating into better customer experiences and healthier bottom lines. More importantly, they tell us how it’s reduced operational burdens and elevated morale, fostering a more engaged and forward-thinking workforce.

Imagine a world where, with just an address or a policy ID, your system instantly surfaces relevant policies, activities, contacts, and detailed document snippets – saving you precious seconds that add up to hours each week.

In moments of crisis, such as natural disasters, this kind of rapid access isn’t a convenience; it’s a necessity. Enabling teams to respond faster means fewer errors, better coverage decisions, and stronger client trust. Our commitment remains unwavering to continuous improvement, strategic partnerships, and expanding capabilities to keep your agency at the forefront of industry innovation.

How are Applied Systems’ AI-Powered Solutions Making an Impact?

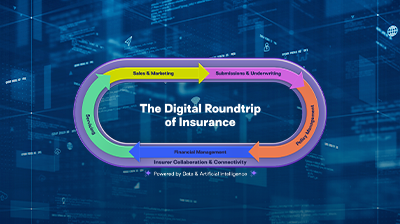

Our investment focuses on technology that seamlessly connects every stage of the Digital Roundtrip - from sales and marketing to policy management, markets, and financials - all integrated within your core system. We see AI as the driving force that will infuse intelligence and automation into each step, empowering you to work smarter, accelerate productivity, and better serve your clients.

We are thrilled to join forces with Cytora, the wunderkind of risk digitalization. Their AI-powered platform transforms the way insurers and agencies handle risk data by taking messy and unstructured information and turning it into actionable, structured insights that support better underwriting decisions. Cytora fits into our vision to infuse AI into every step of the Digital Roundtrip of Insurance, and acquiring Cytora demonstrates our determination to lead the insurance industry into the era of AI and intelligence.

One of our exciting new offerings is Applied Recon™, an AI-driven statement recording and reconciliation tool. It lets users upload direct or agency bill statements in PDF, XLSX, or CSV formats and uses AI to automatically extract and match data to policies and transactions in Applied Epic®. What used to take 15+ hours weekly can now be done effortlessly, freeing agencies to focus on higher-value work.

Our 2025 Voice of Customer survey revealed that 65% of insurance leaders would boost upsell and cross-sell efforts if their teams became 25% more efficient. To support this, we developed Applied Book Builder™, an AI-powered risk intelligence solution integrated into Applied Epic. It streamlines research on potential client risks and identifies optimal coverage, empowering you to strengthen client relationships as a trusted advisor.

Do you find it time-consuming to keep track of email activities, or are you overwhelmed by your communications? The AI in the Email Summarization capability allows you to attach an email in Applied Epic, click a button, and summarize the email into an activity note. Think about how quickly you could act on routine tasks with readily available account data and policy documents, all thanks to AI.

Our AI-powered products don’t stop there. We’re excited to create more AI-powered solutions that empower agencies in this new era of technology and continue to reach new levels of success.

Building the Future of Insurance Together

The future of insurance is not a static endpoint but an ongoing journey of innovation and adaptation. Our roadmap includes rolling out AI-powered search and assistant capabilities within the next year. Together, we stand at the threshold of a new era in insurance where AI is the catalyst that liberates your time, amplifies your insight, and accelerates your success. We’re excited to embrace this future with confidence and collaboration, building smarter, more resilient organizations primed for long-term growth. Read more about our vision and strategy for AI here.

-

Anupam Gupta

Chief Product Officer

Anupam Gupta, Chief Product Officer, is responsible for the company's product vision and product management teams. Formerly CPO at 4C Insights, a sophisticated Data & Analytics SaaS provider to the AdTech/MarTech industries, which was acquired by Mediaocean, the mission-critical platform for omnichannel advertising with more than $200 billion in annualized media spend managed through its software, connecting the ecosystem of agencies, brands, media, technology, and data. As CPO of the combined companies, he spearheaded their product transformation to the cloud, adding new products fueled by data and intelligence infused in the core workflow. Previously, he’s led product organizations for several tech companies, including at Vubiquity, Mixpo, and Microsoft among others.