When considering ways to improve workflow efficiency and strengthen client retention strategies, it's easy to say, "Let's automate it!" But what is automation in insurance, and how does it boost client retention?

Let’s explore how to use intelligent automation to accomplish previously manual tasks, why insurance automation will help with client retention, and how it will give you a competitive edge in the industry.

What is Automation in the Insurance Industry?

Insurance automation blends cutting-edge innovation and the industry expertise of trusted agents. It allows you to automate time-consuming and repetitive tasks to boost operational efficiency, streamline communications, and personalize your interactions to create a better customer experience. For example, instead of doing data entry yourself, the automation solution will do it for you, giving you back more time in your workday.

Reflect on a task, like creating email campaigns or analyzing customer data, and consider what you could accomplish if those tasks didn't take as much out of your time. You wouldn't need to analyze the data yourself, as it would be easily accessible, allowing you to make personalized recommendations and gain valuable insight into future decision-making.

You can easily automate workflows by using artificial intelligence (AI) automation tools to perform specific tasks. Download an app or purchase software to streamline your tasks and minimize human error.

Types of tasks automation can perform but aren't limited to:

- Endorsement requests

- Cancellation and reinstatement monitoring

- Proof of insurance requests

- Claims management

- Policy management

- Customer experience support

- Communications and marketing development

- Administrative and financial support

- Risk assessment and reconciliation

The Beginnings of Automated Workflows

Automation in the insurance industry that you see today has greatly evolved over time. Originally developed in the 1990s, Robotic Process Automation (RPA) was the first type of automation solution available. RPA's take on rule-based tasks across a variety of insurance workflows. This kind of process automation follows predefined rules. In comparison, AI-powered solutions are learning based, meaning they learn from data and make decisions without prior programming and explicit rules.

Why Automate with AI?

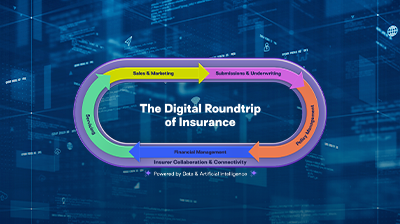

So, why do we care about AI-powered automation systems? AI is a driving force that connects a business across the entire insurance lifecycle. It will enhance every aspect of the Digital Roundtrip of Insurance, making products automated, intelligent, and productive. By leveraging AI, agencies will unlock greater value – maximizing employee productivity, amplifying their growth, and optimizing insurer partnerships. Modern technology gives you time back to develop better relationships with partners, and in turn, boost your customer service. Automation infused with AI can reduce manual, repetitive tasks and elevate the performance of your agency.

Benefits of Adopting Insurance Automation

So, how is automation transforming the insurance industry, and why is it important for client retention? The answer isn't so straightforward.

Automation can assist your agency from start to finish in your insurance workflows. If understanding data to help with customer satisfaction, document processing time, renewals, or risk assessments is keeping you from meaningfully engaging with clients, automation is there to help. Automation tools can tackle mundane manual tasks so that you can focus more on strong client retention.

Here are some benefits of automation:

- Communication with clients is personalized, consistent, proactive, and streamlined

- Operational efficiency is increased, so workflows are optimized for greater productivity

- Decision-making and recommendations are driven by data delivered to you faster

- Customer loyalty is strengthened because of proactive relationship building and a better understanding of the client's needs

- Business scalability is boosted with the extra time saved by eliminating manual tasks

How Agencies Can Adopt Automation Practices

The benefits of automation won't happen overnight. The more informed your decisions are, the greater the benefits you'll reap in the long run.

Here are a few tips for adopting automation in your business:

Do your research: What's the pricing difference between your choices? What sort of cost savings could you experience? Try attending a webinar or reading a case study to learn more about the products. Becoming more knowledgeable about your options will make you feel more confident about your choice.

Reflect on your pain points: Think about where automation solutions could best support your agency. Is it customer onboarding, policy management, claims handling, or something else? It might seem overwhelming at first, but identifying the best use cases for automation systems is helpful.

Prepare to welcome your automation: Regardless of whether you're implementing an AI-powered product or another automation tool, your team needs to be prepared for this change. Develop a change management strategy to address any challenges that may arise. Communicate this change to any stakeholders or policyholders and support your team with any training they may need.

How Does Applied's Automation Technology Help With Client Retention?

Let's take a look at some of Applied's automation solutions that help with client retention:

Applied Book Builder™: An AI-powered risk intelligence tool embedded in Applied Epic that takes business information and creates actionable upsell, cross-sell, and new business opportunities. Applied Book Builder analyzes thousands of public sources to enrich account records with verified business details, highlight coverage gaps that put clients at risk, and flags policies nearing renewal. This tech can help producers and account managers quickly understand client needs, rather than spend time piecing the information together themselves from multiple places. It saves up to 15 minutes on desk research per account. From feedback, we've heard firsthand the excitement that this product will alleviate some of the extra time that account managers historically spend collecting all this information by doing all the research themselves.

Epic Dashboards: An interactive reporting and analytics capability embedded into Applied Epic. Rather than combing through piles and tables of data, you'll experience an easier way to review performance trends, organizational productivity, and other valuable business drivers to help you make more informed decisions. Epic Dashboards allows you to set alerts to help you stay on top of tasks. You can set an alert if there are policies that haven't been renewed, or if activities become overdue.

Applied Marketing Automation: An insurance marketing automation application that allows you to build and track marketing email campaigns, integrated into Applied Epic. Leverage the library of industry-specific curated content to deliver timely content to your clients and prospects. Once you set up a campaign with a dynamic list, watch as clients who fit the criteria will automatically be added to your campaign. Get data-driven insights on the success of each of your campaigns without sifting through piles of information, helping you adjust your campaigns faster for better results.

Future-Proofing Your Agency with Automation

Will insurance agents be replaced by AI-powered products? No. Automation solutions are a way of supporting your agency to ensure long-lasting success and growth. They help to solidify your position as a trusted advisor, not replace your employees. By leveraging automated key touchpoints, like pre-renewal update requests and coverage gap reviews, agents demonstrate their reliability and attentiveness. It deepens the customer relationship which in turn boosts retention.

Automation provides agencies with a competitive edge and keeps them updated with technology and trends. By trends, we don't mean products that will come and go. Workflow automation solutions will revolutionize insurance operations and profitability across the industry.

Rather than cutting costs, automation allows you to cut corners to optimize your operations without compromising service quality. For example, the renewal process will have less friction and won’t be such a time-consuming and repetitive task.

The customer experience changes from end-to-end. From the beginning with customer onboarding, your clients' needs will be addressed with faster, personalized recommendations. Automation tools make accessing policy details, receiving updates, and communicating changes with clients easier.

Think of automation as an upgrade from reactive client retention strategies to sustainable, proactive approaches. As a bonus, automating can also help protect your organization from Errors and Omissions (E&O) exposure since these automated interactions create a documented trail. It's a win-win. Clients feel supported and informed, and agencies protect themselves through smart, proactive automated processes instead of being reactive and manual.

Automate Today, Boost Client Retention for the Future

Embracing the industry's digital transformation with automation for insurance processes provides the competitive edge you need. Manual processes that are replaced with automation don’t replace insurance agents; instead, the two come together to empower agencies for greater client retention. Check out our blog for more resources and expert-informed knowledge on automation and AI-powered products.

-

Charles Frumerie

Principal UX Designer

Charles is a Principal UX Designer at Applied Systems, where he conducts user research, designs solutions, and frames everything in the real context of the user. He’s passionate about understanding the user and meeting them where they are with easy, obvious value. Outside of work, Charles stays active with his amazing, goofy family and hiking/skiing the incredible mountains of Colorado.