Unleashing Even Greater Business Value for Your Agency

Welcome to the Next Generation of Insurance! Our industry stands at the threshold of an exhilarating technological revolution, powered by artificial intelligence (AI) married with insurance expertise and insurance-specific data, or what is known as “Vertical AI.” While any company will be able to access general or “Horizontal AI” models, experts agree that to take advantage of the power of AI, partnering with a vertical market specialist who can train AI models on industry and even company-specific use cases will unlock far greater value.

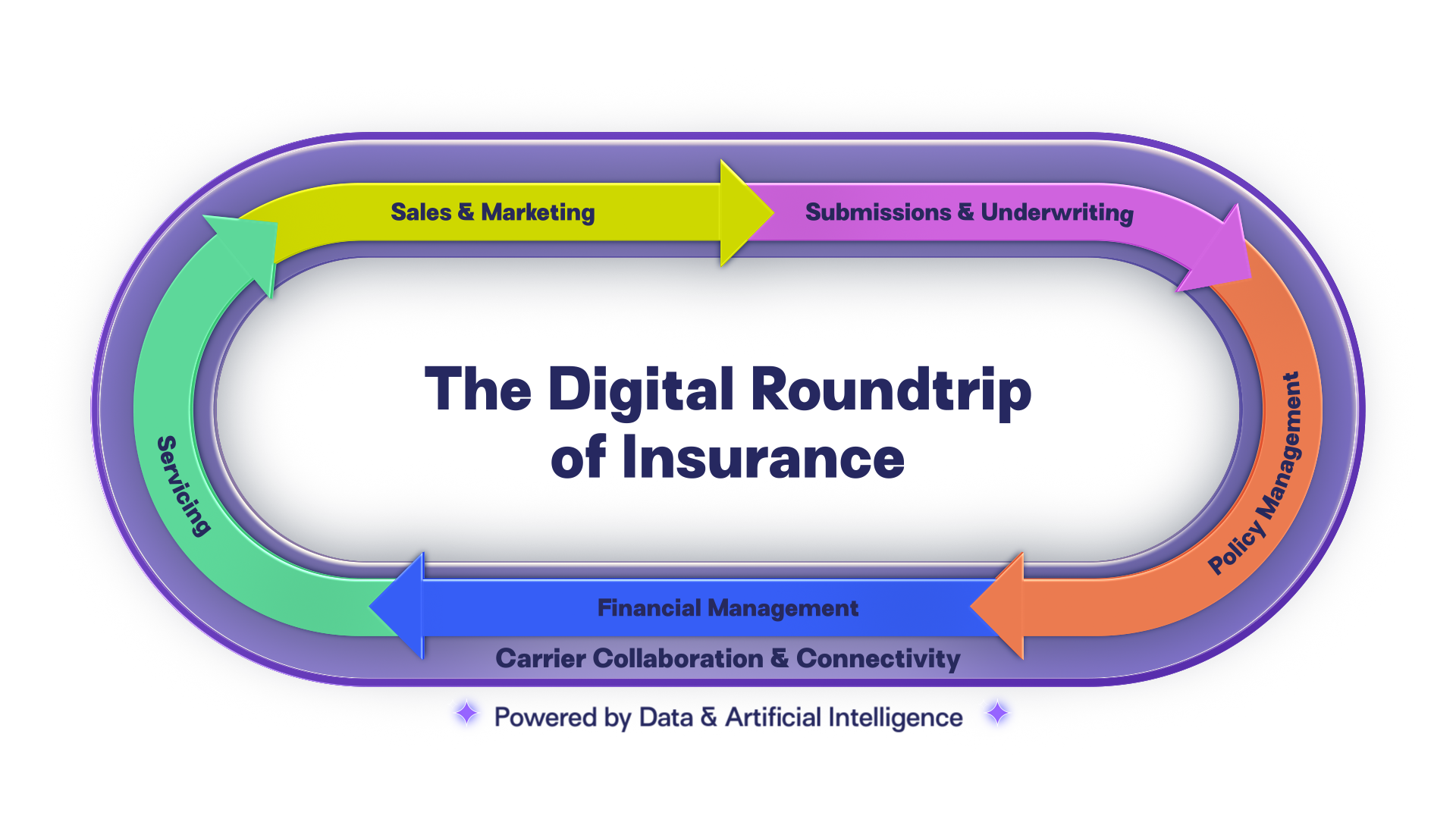

Building on the concept of the Digital Roundtrip of Insurance, which empowered agencies to gain a competitive edge and deliver streamlined customer experiences, the Next Generation of Insurance will elevate that competitive advantage and customer experience even more by providing:

Complete operational transformation for agencies

Enhanced customer service capabilities

Unparalleled efficiency and productivity

gains

Exceptional, personalized agency and customer experiences

Intelligent business insights for making crucial business decisions

This new era promises a more efficient, responsive, and customer-centric insurance ecosystem, attuned to the needs of today’s digital-savvy consumers and insurance professionals. Together, we'll unlock new possibilities, drive innovation, and create lasting value for agencies and clients alike in this exciting new chapter of insurance technology.

Keys to the Next Generation of Insurance

The Next Generation of Insurance is unlocked with data and artificial intelligence (AI) infused throughout the Digital Roundtrip of Insurance. The agencies that implement next-gen tech will propel growth and become more valuable to their staff, customers and partners.

So, what factors will impact all of us as we move into the Next Generation of Insurance?

-

Data & Business Intelligence

In the data-driven landscape, insights are the new currency. And AI is only as good as the data it can learn from. Plus, agents want to focus their time on advising, not gathering data. How do we make data easier to access and turn it into actionable intelligence that quickly serves up answers to your most pressing questions?

-

Insurance Industry Talent Gap

Talent is scarce in our industry, with many seasoned insurance professionals nearing retirement age. According to Accenture, less than 25% of the insurance industry is under the age of 35 and within the next 15 years or so, half of the insurance workforce is expected to retire. Since it’s doubtful we’ll magically find an immediate fix to fill open positions industry-wide, how can insurance businesses better equip their talent to work on the most important things and remove the tedium? How can we equip this industry with the tools needed to attract the next generation of insurance professionals while also managing the total workforce by letting the system do the work for you?

-

Seamless Experience for All Stakeholders

Insurance workflows have historically been time-consuming and cumbersome, requiring jumping across multiple websites and portals, printing out countless pieces of paper and completing other daily manual tasks. How can we make the insurance experience simpler, faster and more enjoyable for all who interact with it, not only for your prospects and clients but also for your team?

-

Real-Time Connectivity

Connectivity is the lifeblood of innovation. Connectivity is critical to automate workflows between the agency, clients and insurer partners. How can connected, intelligent workflows help insurance agencies become smarter about their capacity planning and opportunities to expand their books of business?

These driving forces of the Next Generation of Insurance share the common denominator of modern technology. Next-gen tech will unlock new value for insurance agencies by equipping their people with better experiences, providing them with more connectivity to their clients and partners, and giving them the information and insights they need to work smarter.

Connecting the Digital Roundtrip to the Next Generation of Insurance

The Digital Roundtrip for the Next Generation of Insurance extends technology investments across all the critical stages of the insurance policy lifecycle agents experience day in and day out. It brings core automation across sales, marketing and policy management; connects agents to markets for rating, submissions and servicing; and integrates financial management – all within the core management system.

Data and AI are critical enablers that will show up in helpful ways throughout the journey. Think about AI, not as something distinct from it, but permeating throughout – wherever AI can be used to make products more automated, more intelligent and more productive for you. Over the next several years, based on leading industry analysis from firms like Bain and McKinsey and Applied’s own customer-backed data and research, we expect AI to have a meaningful impact on agencies’ businesses, driving real top-line growth and bottom-line savings, including:

-

Increased Revenue

Implementing AI recommendations during the renewal process can increase effective cross-selling to boost an agency’s revenue by 20-30% by providing data-driven suggestions that cater to individual customer needs.

-

Improved Employee Productivity

AI has the potential to automate most manual tasks, saving agents up to 40-50% of time. For tasks like policy checking and comparisons that take, on average, more than 20 hours a week, agents can take back over 500 hours of time on these tasks alone over the course of the year.

-

Reduced Errors & Omissions

Prefilling data and automating task validation can reduce operational errors by up to 90% in certain processes, significantly reducing E&O.

-

Trained-Up Next-Gen Workforce

Upskill and onboard new team members through integrated AI-driven training and catch-me-up capabilities in half the time of traditional training and development.

According to McKinsey, artificial intelligence is set to transform the distribution, underwriting, claims, and service sectors by integrating AI into core processes. This shift towards an “AI-enabled” model will create a "human in the loop" system, enhancing productivity and enabling more high-quality customer interactions.

Keeping Up with the Competition

-

77%

of insurance professionals indicated in a recent survey they are adopting and finding value in AI.

-

67%

of companies indicated they are piloting large language models (LLMs).

-

57%

of organizations see AI as the most important technology for achieving their ambitions over the next three years.

Succeeding in the Next Generation of Insurance

Succeeding in the Next Generation of Insurance requires a connected, intelligent ecosystem of workflows across lines of business and core agency functions. It requires the focus of a technology specialist with deep experience in the insurance vertical, an integrated approach to software development, the largest network of carrier connectivity, and a unique insurance data set to deliver vertical-specific data insights and AI solutions that ensure agencies focus their time where it matters most.

An AI-amplified Digital Roundtrip operating on an agency’s rich book of business data unlocks next-generation value to maximize staff productivity, amplify book of business growth, optimize insurer partnerships, and improve insured satisfaction.

AI experts agree that the most valuable application of AI-enabled solutions will be in vertical, market-specific use cases. Unlike more general horizontal AI tools, AI solutions should be crafted specifically for insurance. By doing so they will provide better, more targeted results for you and your agency, such as enhanced risk assessments based on historical data, the ability to identify emerging risks and cross-sell opportunities more quickly, and tailor recommendations for coverage limits based on specific client profiles. Additionally, vertical AI will help automate routine tasks like comparing key policy renewal details, reconciling commission statements, or just searching for account information – all of which can eat up a ton of time for servicing and finance staff. Insurance-specific AI can do things horizontal AI cannot, like serve up recommendations that could grow premium profitability while automating hours of tasks out of the day to better control bottom-line costs.

Vertical AI vs. Horizontal AI: Key Differences

-

Vertical AI

Vertical AI solutions are tailored for specific industries and use cases. They're specialized tools that only address the tasks they're designed to do.

-

Horizontal AI

Horizontal AI solutions are general-purpose tools that have a wide range of tasks and abilities. They can be used in a variety of industries and are highly versatile.

When AI capabilities live natively within the insurance ecosystem, agencies can confidently use them, knowing their data remains within the security infrastructure of existing systems and processes. AI systems should be designed and developed with ethical considerations in mind, be transparent in their decision-making processes, be accountable for their actions, and comply with laws and regulations.

Pushing Agencies Forward

Embracing next-gen tech in the following areas will push agencies forward in the Next Generation of Insurance by delivering meaningful value at every stage of the Digital Roundtrip:

Sales & Marketing

Agency staff are insurance professionals and trusted advisors who often do not have the time to think about and craft the perfect email communication in hopes their contacts will read and engage with their calls to action. Not all organizations have a marketing representative or team to write compelling, on-brand emails for them. Tools like ChatGPT can be used to help generate email content but work outside of the email-building workflow and ultimately lack the insurance domain expertise necessary to ensure not only the messaging is compelling, but the language, terminology, and value-added content are optimized for insurance agencies and their customers.

Accessible natively within the agency management system, an integrated, generative AI tool purpose-built for insurance agents can assist in creating clear, concise, and engaging communications. Agents can then easily place prospects and clients into a drip marketing campaign, send a one-off piece of content to help nurture the relationship, decide the content’s length, formality, and subject matter, and let the power of generative AI technology provide descriptive text to catch the recipient’s attention. Agents remain in the driver’s seat giving final approval prior to sending an email that is sure to pique the recipient’s interest.

With insurance-specific AI-powered content creation natively embedded in email and campaign-building workflows, marketers and other agency staff can free up hours and create more engaging content that wins and retains customers.

Submissions & Underwriting

The manual, time-consuming email exchange of forms and information between an agency and carrier during the commercial underwriting process prevents them from working together effectively. The breadth and variety of forms required for commercial submissions – ACORD forms, customer forms, carrier supplementals – live in multiple systems and are delivered inconsistently. Carrier feedback indicates that fully one in three commercial submissions are never even reviewed by an underwriter due to this complexity and resulting backlog, making it challenging for carriers to underwrite desired business and agency partners from optimally placing it.

The power of AI can be leveraged throughout the agency and carrier submission interaction to drive efficiency and better relationships. Insurance-specific AI can identify coverages for an insured, make recommendations on where an agency should place the risk based on known markets for similar risks, and easily pre-fill the forms with risk data directly from the management system. An AI-powered document-understanding engine can take these forms and turn them into digitally structured information, enriching the risk profile with online commercial insights and underwriter/producer email communications. AI-augmented commercial submissions seamlessly route to underwriters for consolidated review and faster processing. This connectivity creates the opportunity for a unique collaboration experience between the underwriter and the agent in a single pane of glass, where questions and communication on missing information, submission status and more happen seamlessly.

Policy Management

Renewals are one of the most critical stages in the policy lifecycle and vital to maintaining a healthy, growing book of business. Renewals are also a great opportunity for accurately assessing the risk of the current policy and identifying additional client needs, pointing to which additional coverages could be valuable to your client while also increasing your revenue growth. However, easily identifying the right account rounding opportunities within a book of business requires a lot of research into clients’ risks – asking insureds for information, visiting third-party resources or bookmarked databases, followed by entering and submitting information to carriers. Yet, when we asked agencies to rank top sources for growth over the next five years in our 2024 Voice of Customer survey, account rounding was cited as the #1 under-leveraged growth opportunity. Account rounding recommendations were ranked as the top insights agencies wanted to see embedded into management system workflows. There are massive premium upsell opportunities within agencies’ existing books that insurance-specific AI solutions can help unlock.

Integrated and accessible natively in the agency management system, an AI-powered growth engine helps identify high-probability cross-sell and upsell opportunities when renewing a policy. The technology leverages AI to highlight coverage gaps based on account attributes, NAICS code, and existing coverage in the current customer policy. Best-fit markets are suggested for each risk by examining where an agency has had the most success in the past and provides seamless bridging to quoting and submission workflows. All of this is only possible with the rich insurance data in the system and the industry knowledge that understands the complexity of commercial lines policies and market nuances.

Leveraging AI-powered commercial account rounding helps agencies increase the premium value of every account and generate a more profitable book of business. Better assessing a customer’s exposures and ensuring they get the right coverage also results in fewer uninsured claims and a reduction in E&O exposures.

Financial Management

Reconciling transactions with carrier statements to ultimately balance the books, pay producers, and make money for the agency works well for downloaded direct bill lines of business. However, many direct bill or agency billed policies and carrier statements do not download and are often delivered in unstructured PDFs or even paper forms with hundreds, even thousands of records to process manually.

Reconciling direct bill commissions and agency-billed vendor payables were reported as the top two most common day-to-day tasks for finance/accounting users in our most recent Voice of Customer survey. As we dug in with users on these workflows, we heard this manual gathering of statements and data recording can take 15+ hours per week for accounting staff. Some organizations have entire teams dedicated to this work and/or are outsourcing at a significant cost.

There is a much better way to do this critical but cumbersome reconciliation work. A natively embedded solution within the management system accounting General Leader creates a single workflow that eliminates the physical and digital “swivel chair” between disparate systems and printed statements while delivering automated statement reconciliation for direct bill commissions and agency bill carrier payables. In both scenarios, imagine simply uploading statements in any form, a scanned image PDF, CSV, etc., and let AI work its magic – extracting information like dates, premiums, policy or plan numbers, and commissions, transforming these into structured financial data that can be reviewed and validated before importing and automatically reconciling to premium payables.

AI-powered accounting automation helps finance and accounting teams move money faster for your business while reducing your back-office costs, helping you drive more profitable revenue growth.

Servicing

Client service is core to the independent agency's value proposition. Quickly finding and understanding information needed to assist your clients while accurately maintaining records and documentation are key to helping your servicing staff deliver higher value to your clients while reducing your account management costs. Our Voice of the Customer survey found that in addition to renewals, service team members spend almost their entire day managing customer communications and policy changes. Efficiency is the most valuable benefit of an agency management system, but these routine tasks remain highly inefficient.

Accessible from within the management system or Microsoft Outlook, an AI-amplified servicing tool enables agency staff to access information and execute tasks like identifying accounts, adding activities, and auto-summarizing emails with seamless data connectivity. Using management system policy and account data, policy and endorsement documents, and customer communication, users can prompt and answer common questions about policy details, account information, and more to quickly find the information they need to service their clients’ needs.

AI-assisted servicing helps agencies increase overall productivity with smart, time-saving tools across the most common, manual day-to-day agency tasks. Managing and saving emails to a management system can take half as long and answering simple to complex questions can happen in seconds rather than 20+ minutes. Less time spent on inefficient tasks means more time spent on building and nurturing client relationships.

Core Innovation & Connectivity

Core innovation and connectivity are about modernizing and seamlessly integrating the varied facets of insurance technology into one coherent system. By focusing on the Digital Roundtrip in management systems, agencies are empowered with unparalleled connectivity and streamlined workflows. Leveraging robust automation and real-time data insights, next-gen tech focused on core innovation and connectivity will ensure that every aspect of your business operates at peak efficiency. This integrated approach not only enhances agency productivity but also provides a solid foundation for sustainable growth.

As we continue emphasizing a customer-centric approach, leveraging insurance technology for secure and transparent transactions will be critical. The evolution of these technologies is shaping the modern insurance landscape, ensuring that agencies remain competitive and innovative. With advanced interfaces, agencies can interact seamlessly with their clients, enhancing the overall experience.

Provide the Best Customer Experience with Next-Gen Tech

Embracing next-generation insurance technology is no longer a choice — it's a necessity for success in this rapidly changing world. We’re here every step of the way to help insurance agencies unlock the incredible potential of these transformative technologies, fully utilizing the power of data analytics and AI integration. Now is the time to reimagine your agency's future. This is your opportunity to harness emerging technologies to build stronger connections, boost efficiency and productivity, and deliver outstanding customer experiences from new business insights.

Tech to Push Your Agency into the Next Generation of Insurance

In the dynamic world of insurance, the agency management system stands as the backbone of transformative change, enabling the integration of AI, data insights, and seamless end-to-end connectivity. When the management system harnesses automation and real-time business intelligence, agencies can streamline operations, enhance customer experiences, and unlock unprecedented business value.

As we navigate the Next Generation of Insurance, let's explore the next-gen tech paving the way for this next era in insurance:

Applied Epic

Applied Epic® is the world’s most widely used management platform. It allows you to manage and maintain a clear picture of your entire agency across all roles, locations and lines of business, including both P&C and benefits. It’s browser-native so your team can easily access data, minimize software management and more quickly realize the value of new capabilities. With its integrated tools, native AI capabilities, and continuous development by experienced insurance and technology professionals, Applied Epic is designed to drive growth, enhance productivity, and maintain high service levels. Our specialization differentiates us in the market and enables us to deliver more value through AI than any player in the market to make your business more valuable.

Applied Book Builder

Leveraging the power of generative AI and machine learning, AI-powered Applied Book Builder™ enriches commercial risk profiles based on thousands of publicly available information sources to round out risk profiles and identify coverage gaps within existing policies, creating cross-sell and upsell opportunities. Embedded in Applied Epic, these commercial risk attributes also pair with corresponding market placement insights to help you submit business to carriers likely to fit your customer’s needs.

Epic Dashboards

Epic Dashboards, seamlessly integrated into Applied Epic is revolutionizing how insurance agencies harness data. This groundbreaking tool democratizes access to the extensive information housed within Applied Epic, transforming it into dynamic visualizations that empower every member of your team. Epic Dashboards provides tailored insights for agency leaders and team members, enabling a deeper understanding of important technology trends. Whether you're analyzing your book of business, evaluating employee workload balance, or identifying your most preferred carriers, these data analytics insights offer a clear, actionable perspective.

Epic Quotes Commercial Lines

Epic Quotes Commercial Lines (EQCL), embedded in the Applied Epic agency management system, is about making simple commercial quoting easier and more scalable. It allows agents to input customer and risk information just once, drastically cutting down the time-consuming, repetitive data entry and workflows across multiple carrier sites that can eat up your day. It covers a broad range of lines of business, from General Liability and Business Owner's Policy (BOP) to Workers’ Compensation and Cyber insurance, connecting seamlessly with over 35 commercial markets. This tool is a no-brainer for agencies keen on enhancing workflows, increasing profits, and boosting efficiency in commercial lines rating.

Applied Pay

Applied Pay®, the insurance industry’s most versatile digital payments platform, provides a safe, convenient way for insureds to pay their premiums online from any device and integrates seamlessly with Applied Epic, Applied CSR24® and EZLynx®. Applied Pay now delivers a comprehensive suite of payment solutions, incorporating automated physical check acceptance and embedded premium finance through industry-leading providers.

Embracing the Next Generation of Insurance

The Next Generation of Insurance holds incredible opportunities for the insurance industry. From the opportunity to drive significant growth to optimizing staff productivity – all while balancing a generational shift in talent – agencies stand to create greater value than ever before through rapidly advancing technology. However, to make that technology work hardest and most effectively, partnering with the insurance industry’s leading specialist to take advantage of insurance-specific solutions is the key. Applied Systems is ready to work with you to help your agency thrive in this Next Generation of Insurance.

Ready to Learn More?

When you’re ready to learn more about leveraging advanced insurance software and solutions to build a better insurance business, we’re here to help.